Full cost markup formula transfer pricing

English term or phrase. The full-cost calculation is simple.

1

2500000 Production costs 1000000.

. First the transfer pricing policy for housing components would change to use variable cost to the components division. For example if a laptop costs 100 to produce but can sell for 700 on the open market then company A charges company B 700 per laptop. In the article the Resale Price Method with example we look at the details of this transfer pricing method provide a calculation example and indicate when this method should.

While its a transaction-based method. Total production costs selling and. FCMU Full cost mark upin this instance the FCMU has been selected as the profit level indicator to be tested.

In order to ensure that the selling division. The cost plus transfer pricing method is a traditional transaction method which means it is based on markups observed in third party transactions. Cost-plus method Under Paragraph 15 of the Regulation this method is applied to the transactions of the seller manufacturer of goods products or provider of services if the.

Using this method markup is reflected as a percentage by which initial price is set above product cost as reflected in this formula. Further full cost transfer pricing can provide perverse incentives and distort performance measures. A full cost transfer price would have shutdown the chances of any negotiation.

Thus TP COGSx 1 M. The calculation for setting. The groups total profit amounts to 80 cents per pen.

The full-cost calculation is simple. Company B then sells the. A company may set the transfer price at full cost also known as absorption cost which is the sum of variable and fixed costs per unit.

Full-cost pricing is one of many ways for a company to determine the selling price of a product. A US-based pen company manufacturing pens. Total production costs selling and.

The full-cost calculation is simple. It determines the full markup achieved. A clothing company reports its production costs as.

Transfer pricing refers to the prices of goods and services that are exchanged between companies under common control. Thus if we formulate the transfer price under Cost Plus Method it would be equal to COGS Markupwhere Markup is arrived by COGS x Markup. Price Cost per unit 1 Percentage markup Lets take an example.

The following is the cost-plus pricing formula. Transfer pricing is the method used to sell a product. O The Arms Length Price for the original transfer of property between the associated enterprises is then given by the difference between the Resale Price and the Gross Margin o Financial Ratio.

Based on this information and using the full cost plus pricing method ABC calculates the following price for its product. You then divide this number which should include the price of all units produced by the number of units you expect to sell. The FD wants to know the impact of the change in transfer pricing policy.

Product Cost Price Profit Calculator Ebay Etsy Mercari Etsy Price Calculator Excel Spreadsheets Spreadsheet Template

Pin On Products

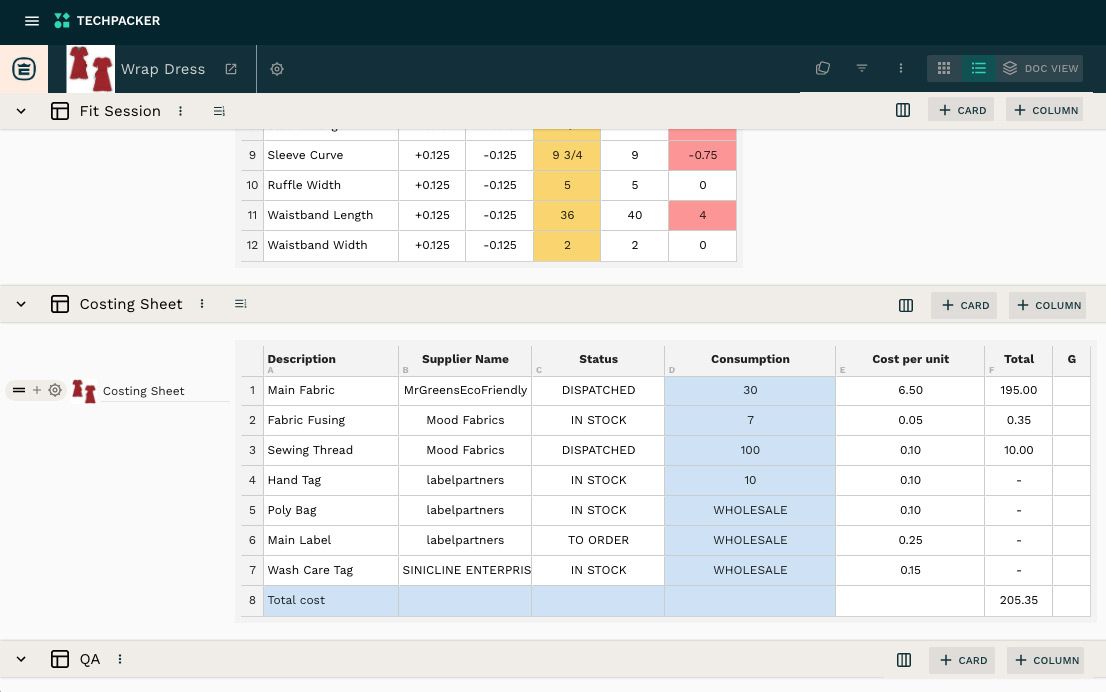

Everything You Need To Know About Garment Costing And Pricing

Pricing

1

Sap Analytics Cloud Transfer Pricing Prepackaged Solution Simplefi Solutions

Revision Lecture 32 Readings Ppt Download

Revision Lecture 32 Readings Ppt Download

Profit Formula Profit Percentage Formula And Gross Profit Formula

How To Calculate Selling Price From Cost And Margin Calculator Excel Development

Premium Pricing Strategy Pros Cons Examples

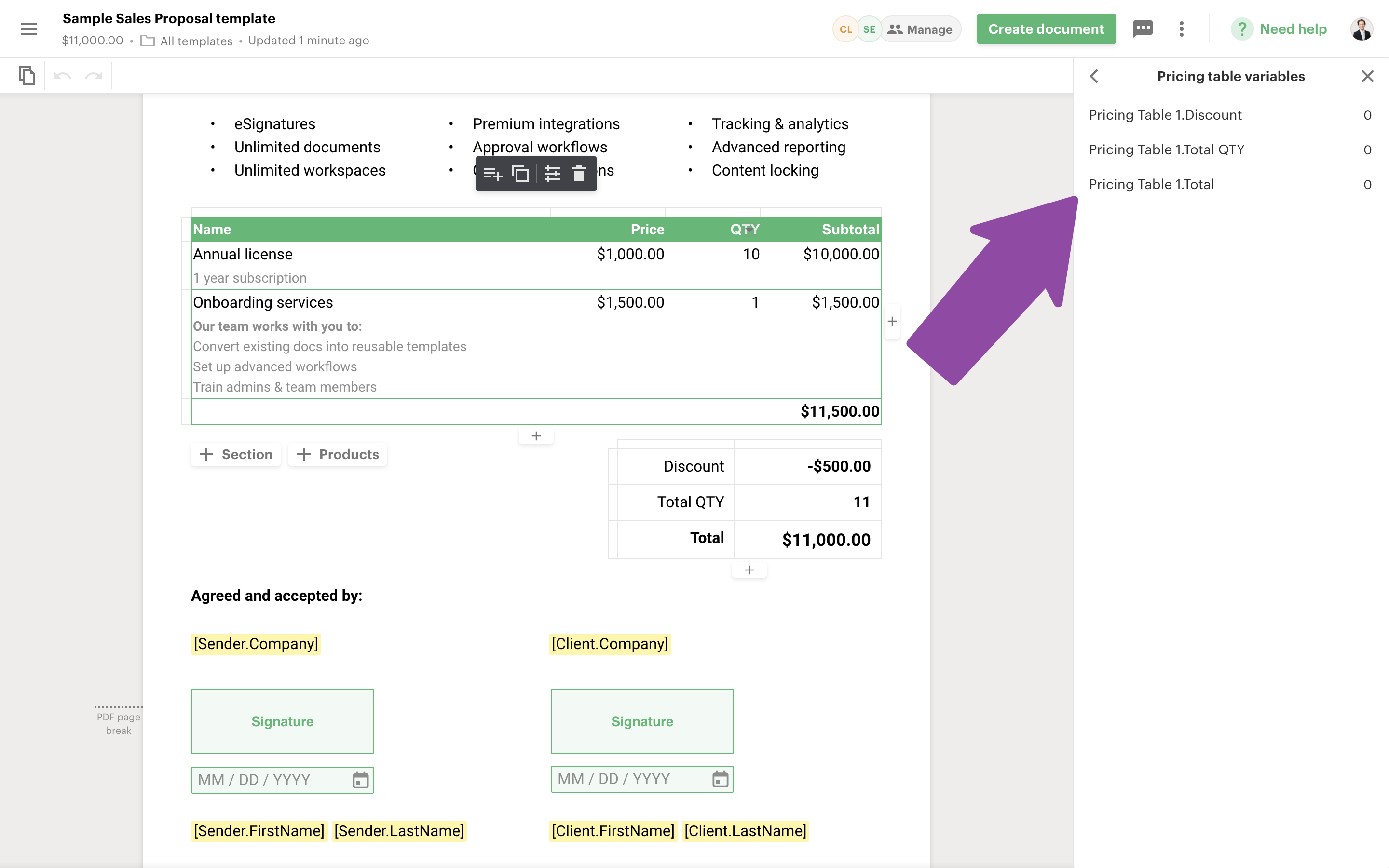

Pricing Table Add And Set Your Pricing Table Help Center

Clothing Manufacturing

Product Cost Price Profit Calculator Ebay Etsy Mercari Etsy Price Calculator Excel Spreadsheets Spreadsheet Template

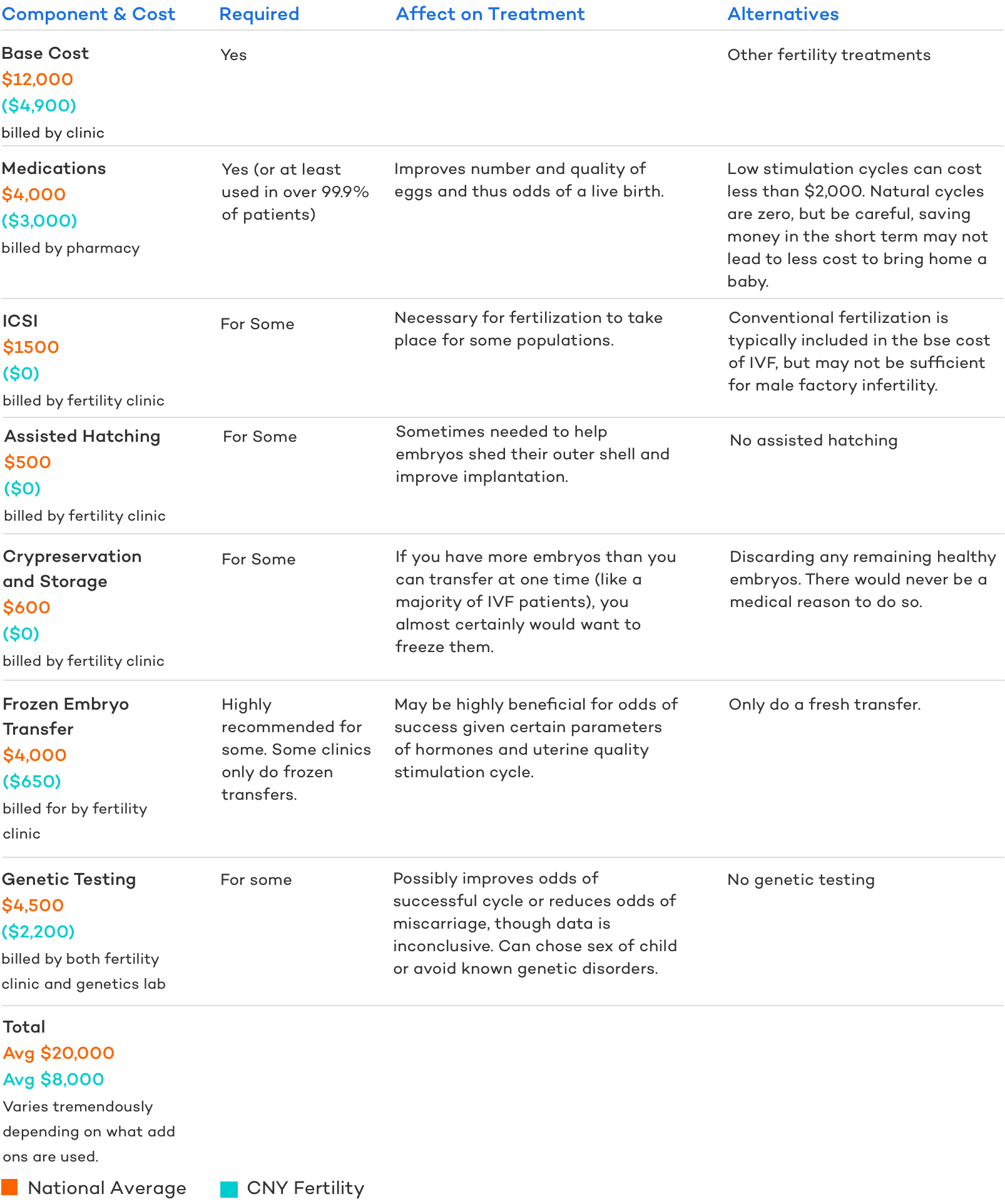

Ivf Cost From 3 995 To Over 100 000 But How

Plan De Empresa Para Creativos Tics Y Formacion Plantilla De Plan De Negocios Planificacion Empresarial Ejemplo De Plan De Negocio

Pin On How To Get What You Want